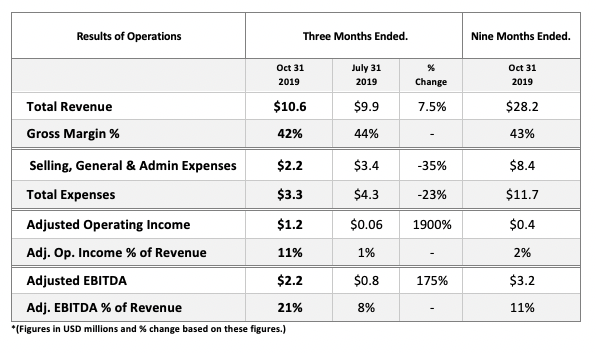

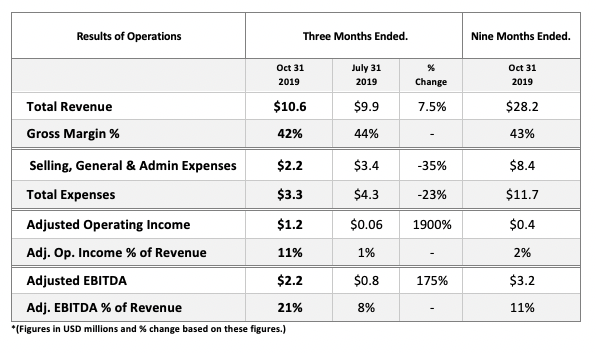

Adjusted EBITDA up 175%; Adjusted Operating Income up 1,900%

VANCOUVER, December 30, 2019 – C21 Investments Inc. (“C21”) (CSE: CXXI and OTCQB: CXXIF) today reported unaudited financial results for the third quarter of fiscal 2020 ending October 31, 2019. Unless otherwise stated, all currency is in US dollars, and all results are preliminary.

Third Quarter Highlights (unaudited)

- Q3 revenue was $10.58 million, an increase of 7.5% versus Q2.

- Nine months year-to-date revenue of $28.2 million.

- Adjusted EBITDA[1] of $2.2 million, up 175% from Q2; the third consecutive positive quarter.

- Adjusted Operating Income1 totalled $1.2 million, an increase of 1,900% over Q2.

- Gross Margins continued steady at 42% (44% in Q2; 43% in Q1).

- Commenced trading on the OTCQB® Venture Market under the symbol “CXXIF”.

“We delivered impressive third quarter results reflective of the significant progress we made toward our strategic objectives. We rationalized our operations, achieved improved efficiencies, and have sharpened our focus on leveraging the strong brand awareness of our product portfolio. The positive changes we are making better position C21 for success over the long-term,” said Sonny Newman, President and CEO, C21 Investments.

Additional Operating Highlights:

- Q3 reported a record 172,694 customer transactions at Silver State Relief dispensaries, an 8% increase over Q2, and a 24% increase from Q1. Year-to-date customer transactions now exceed 580,000.

- C21’s Q3 market share now represents 5% of total State of Nevada cannabis sales.[2]

- After launching Oregon brand Hood Oil in Nevada in June, sales have now surpassed 84,000 units generating revenues of $2.4 million. Hood Oil vape cartridges continue to outsell all other vape cartridges combined in Silver State dispensaries.

- C21 continues to leverage the vertical integration of its businesses by bringing our strong Oregon brands online in Nevada, which now include Phantom Farms CBD line of products, pre-rolls, with Phantom flower awaiting state approval of packaging.

- Phantom Farms’ indoor A-grade flower prices rebounded strongly this fall to $1,400 per pound, from a low of $500 per pound earlier this year.

- Phantom Farms successfully completed a bountiful fall outdoor harvest. Outdoor flower prices have rebounded to $850 per pound, from a low of $250 per pound earlier this year.

“Strategically we set a course to become an efficient and profitable business with strong fundamentals. This has resulted in significant growth in adjusted EBITDA and operating cash flow results for the quarter, positioning the company to become profitable in the near term.” said Michael Kidd, Chief Financial Officer, C21 Investments.

As part of the restructure and integration of the Oregon operations, C21 Investments undertook an appraisal of the Oregon leaseholds and real estate assets. This resulted in a write-down of $4.2 million in the quarter. This one-time charge reduces Q3 earnings per share by 5 cents to ($0.06). Excluding one-time charges, earnings are ($0.01) per share.

C21 Investments continues to assess strategic opportunities to achieve the financial flexibility necessary to capitalize on growth opportunities and meet its future debt obligations.

Key Performance Measures:

1: Adjusted EBITDA and Adjusted Operating Income are non-IFRS financial measures, in which IFRS does not prescribe any standard definitions. As a result, the Company’s Adjusted EBITDA and Adjusted Operating Income included herein are not necessarily comparable to similar measures presented by other issuers.

2: Includes State of Nevada data for August and September. Nevada Sales for October are not yet available. https://tax.nv.gov/uploadedFiles/taxnvgov/Content/TaxLibrary/NV-Marijuana-Revenue-FY20(2).pdf

The CSE has not accepted responsibility for the adequacy or accuracy of this release.

| Media contact: Skyler Pinnick Chief Marketing Officer and Director Sky.Pinnick@cxxi.ca +1 833 BUY-CXXI (289-2994) |

Investor contact: Michael Kidd Chief Financial Officer and Director Michael.Kidd@cxxi.ca +1 833 BUY-CXXI (289-2994) |

About C21 Investments Inc.

C21 Investments is a vertically integrated cannabis company that cultivates, processes, and distributes quality cannabis and hemp-derived consumer products in the United States. The Company is focused on value creation through the disciplined acquisition and integration of core retail, manufacturing, and distribution assets in strategic markets, leveraging industry-leading retail revenues with high-growth potential multi-market branded consumer packaged goods. The Company owns Silver State Relief and Silver State Cultivation in Nevada, and Phantom Farms, Swell Companies, Eco Firma Farms, and Pure Green in Oregon. These brands produce and distribute a broad range of THC and CBD products from cannabis flowers, pre-rolls, cannabis oil, vaporizer cartridges and edibles. Based in Vancouver, Canada, additional information on C21 Investments can be found at www.sedar.com and www.cxxi.ca.

Cautionary Statement:

Certain statements contained in this news release may constitute forward-looking statements within the meaning of applicable securities legislation. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Forward looking statements in this news release include the unaudited financial results of the three-month period ending October 31, 2019 (Q3), estimated Q3 revenue and year-to-date revenue, estimated Q3 adjusted EBITDA and operating income, estimated Q3 gross margin, the calculated Q3 and year-to-date customer transactions in Nevada retail operations, unaudited retail sales performance in Nevada retail operations, the performance of our Company brands, the calculated price of cannabis flower in Oregon, the fact and timing of net profitability of the Company, the ability of the Company to capitalize on growth opportunities and meet its future debt obligations, the impact of certain acquisitions on the Company’s financial information, and continued demand for cannabis products.

The forward-looking statements contained in this news release are based on certain key expectations and assumptions made by C21 Investments. Although the Company believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because C21 Investments can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, consumer acceptance of the Company’s products, the failure to execute on its acquisition and expansion strategies, competitive factors in the industries in which C21 Investments operates, the Company’s inability to finance current or future operations, prevailing economic and regulatory conditions, and other factors, many of which are beyond the control of C21 Investments. The forward-looking statements contained in this news release represent the Company’s expectations as of the date hereof and are subject to change after such date. C21 Investments disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

Notice regarding Forward Looking Statements: This news release contains forward-looking statements. The use of any of the words “anticipate”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “should”, “believe” and similar expressions are intended to identify forward-looking statements. Although the Company believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. These statements speak only as of the date of this news release.