C21 Investments Announces Q1 Results

Fifth Consecutive Quarter of Positive EBITDA

VANCOUVER, August 13, 2020 – C21 Investments Inc. (“C21” or “The Company”) (CSE: CXXI and OTCQB: CXXIF) today announced unaudited results for its first quarter ended April 30, 2020.

Q1 Highlights: (all currency in U.S. dollars)

(February 1, 2020 to April 30, 2020):

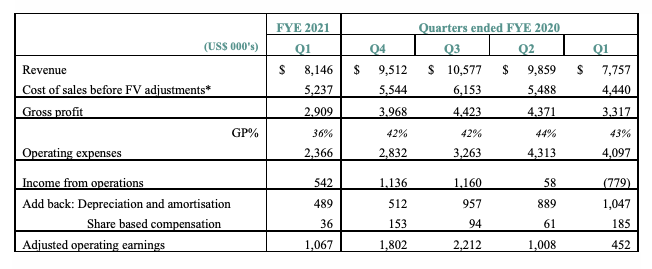

- Revenue of $8.15 million – a Year-over-Year increase of 5%; achieved 86% of Q4 Revenues notwithstanding 6 weeks of delivery-only restrictions in Nevada

- Gross Profit of $2.9 million (before fair value adjustments) – Gross Margin of 36% – reflecting higher cost of sales due to Covid-19

- Adjusted EBITDA[1] of $0.9 million – the fifth consecutive positive quarter

- Cash Flow from Operations of $1.4 million

- Income from Operations of $0.5 million (before fair value adjustments)

- Total Liabilities reduced by $2.5 million

- Net loss, excluding a non-cash, one-time restructuring charge, of ($0.00) per share[2]

Management Commentary:

In Q1, Nevada regulators limited statewide cannabis sales to delivery-only due to the COVID-19 pandemic. C21 successfully mitigated the impact of these restrictions, which included six weeks of operating with “delivery-only” at the Nevada dispensaries. The team quickly pivoted to new sales channels, which initially included increasing third-party delivery, while subsequently establishing an in-house delivery capability. As restrictions eased at the end of the quarter, the Company engineered curbside pickup as its third sales channel. C21 continued to streamline its Oregon operations and in February acquired the Phantom Farms real estate associated with its outdoor farms in Southern Oregon.

Company President and CEO, Sonny Newman said, “We met the challenges imposed by the pandemic head-on and thanks to the hard work of the team, we have strengthened the Company for the future. We have seen the impact of these efforts in our Q2 sales results, where we rebounded to record revenue at our Nevada dispensaries. As we prepare for the next stage of growth, we are confident in the strong operational foundation we have built.”

Revenue for Q1 was $8.15 million, up 5% from Q1 last year and 86% of the Q4 revenue. The Company’s Gross Margin was $2.9 million (36%), before fair value adjustments. This reflects the increased sales costs resulting from the six week period of “delivery-only” operations and costs associated with integrating the Oregon operations.

During Q1, Sales, General and Administrative totaled $1.8 million. C21’s Total Liabilities were reduced by $2.5 million. The Company recorded a one-time, non-cash restructuring charge of $1.2 million from the final settlement of the acquisition of Phantom Farms. The Net Loss per Share for Q1 is ($0.02). Excluding the one-time, non-cash restructuring costs, Net Loss per Share is ($0.00).

Despite six weeks of the dispensaries being closed to in-store sales, C21’s Nevada operations remained one of the most profitable in the cannabis sector, with the segment delivering $2.2 million in Net Income Before Tax for the quarter and a 48% Gross Margin. The Company’s consolidated Net Income Before Tax excluding the restructuring costs was $0.3 million.

Subsequent to the first quarter, the Company has continued to service its debt through operating cash flows, reducing the principal amount of its notes payable by an additional $2.4 million. Silver State Relief has successfully navigated the challenges of operating under COVID-19 restrictions in Nevada and is now reporting record run rate sales. The further roll-out of Oregon brands into Nevada continues to be highly successful, with Hood Oil and Phantom Farms flower performing as top selling products in our retail stores. The Company believes its profitable dispensary model and scalable cultivation and extraction facilities in Nevada will generate strong future growth for the Company.

There have been no other material business developments in the Company’s operations which have not previously been disclosed.

Quarterly Adjusted Operating Earnings:

[1] Adjusted EBITDA is a non-IFRS financial measure, in which IFRS does not prescribe any standard definitions. As a result, the Company’s Adjusted EBITDA included herein is not necessarily comparable to similar measures presented by other issuers.

[2] Net Loss, excluding non-cash, one-time restructuring charge, of ($0.3) million.

| Media contact: Skyler Pinnick Chief Marketing Officer and Director Sky.Pinnick@cxxi.ca +1 833 BUY-CXXI (289-2994) |

Investor contact: Michael Kidd Chief Financial Officer and Director Michael.Kidd@cxxi.ca +1 833 BUY-CXXI (289-2994) |

About C21 Investments Inc.

C21 Investments is a vertically integrated cannabis company that cultivates, processes, and distributes quality cannabis and hemp-derived consumer products in the United States. The Company is focused on value creation through the disciplined acquisition and integration of core retail, manufacturing, and distribution assets in strategic markets, leveraging industry-leading retail revenues with high-growth potential multi-market branded consumer packaged goods. The Company owns Silver State Relief and Silver State Cultivation in Nevada, and Phantom Farms, Swell Companies, Eco Firma Farms, and Pure Green in Oregon. These brands produce and distribute a broad range of THC and CBD products from cannabis flowers, pre-rolls, cannabis oil, vaporizer cartridges and edibles. Based in Vancouver, Canada, additional information on C21 Investments can be found at www.sedar.com and www.cxxi.ca.

Cautionary Statement:

Certain statements contained in this news release may constitute forward-looking statements within the meaning of applicable securities legislation. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Forward looking statements in this news release include the ability of the Company’s Nevada retail locations to operate at record run rates, the performance of the Company’s operations generally, and specifically its Nevada retail and first-party delivery operations, during the pendency of the COVID-19 pandemic, the continued profitability of the Company’s Nevada operations, the ability of the Company to continue to streamline its operations in Oregon and sell non-core assets, the Company’s ability to continue to service its debt through operating cash flows, the Company’s ability to pursue growth opportunities and generate future growth for the Company, the quality of the Company’s Phantom Farms real estate assets, the performance of the Company’s brands and the continued demand for cannabis products, and the nature and extent of the impact of the COVID-19 pandemic.

The forward-looking statements contained in this news release are based on certain key expectations and assumptions made by the Company, including the ability of the Company to restructure its secured debt and to service its restructured debt. Although the Company believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, the consequences of not restructuring its secured debt, the ability to service its debt, if restructured, risks and uncertainties arising from the impact of the COVID-19 pandemic on the Company’s operations, and other factors, many of which are beyond the control of the Company.

The forward-looking statements contained in this news release represent the Company’s expectations as of the date hereof, and are subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.